UNDERSTANDING SHOPPER LOYALTY IN EURASIA & AFRICA

The expansion of grocery retailing outlets in Eurasia and Africa is offering shoppers new choices and altering the balance of preferences in the market. There is no single model for the movement of grocery shopping preference; the pace of demand growth, as well as the evolution of shoppers’ loyalties to channels vary considerably due to a number of variables including geography, culture, investment climate etc. However, there are two significant points within that continuum:

•Where new trade formats emerge in areas served by traditional retailing, and start offering shoppers the opportunity to change their preferred type of outlet to so-called “modern” stores ;

•Where the modern trade momentum is well-established and different formats of modern trade emerge with shoppers switching between them.

For its inaugural study, The Coca-Cola Retailing Research Council for Eurasia and Africa (CCRRC Eurasia & Africa) has designed, as its main objective, to understand and define the triggers for shoppers in Eurasia/Africa to switch at each of these two critical points of the retail continuum: from traditional to modern trade; and then, within modern trade, between formats.

By deeply understanding shopper motivations to shift their allegiance from traditional to modern trade formats, as well as within different modern trade formats – and vice versa - all retailers will be able to refine and strengthen their respective shopper propositions, based on the main drivers for shopper loyalty by format:

•Retailers in the traditional trade will be better equipped to sustainably service the needs of their shoppers, in an increasingly competitive world;

•Retailers with (a range of) modern formats will be able to act on the main drivers for shopper loyalty for each format, thus enabling future growth.

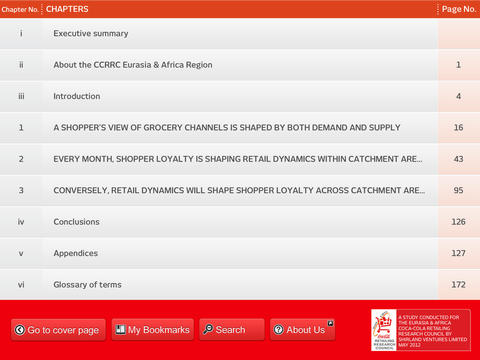

This study has been conducted by Shirland Ventures Ltd and undertaken to understand three different themes that help retailers in Eurasia and Africa better understand shopper loyalty and strengthen their respective business propositions:

•Understand and create a shopper-centric view of channels which explains the reasons for repeat purchase or loyalty

•Understand clusters of loyalty, and their triggers, in different channels and demographic areas across this diverse region revealing variations which have implications for retailers’ investment strategies

•Develop a shopper-centric means of forecasting the future channel landscape in 2015 and 2020 across the region

This report summarises the conclusions of the study and sets out recommendations. It is intended to be read by retailers in Eurasia and Africa as the primary audience. However, other constituencies will find topics of interest to refine their own understanding of shopper behaviour and its future in this region and beyond:

•Consumer products marketers seeking to optimise their brand and product segmentation

•Universities and Business Schools studying retailing, distribution and the development of consumption and shopping habits

•Institutions planning better coordination between the general population and food retailers